The central hypothesis of my paper is that a time-series with high autoregressive affinity and whose dynamics are primarily governed by internal forces or participants, can be partitioned into segments of even length and those segments will generally fall into certain families. An example of this in the financial world can be Crypto or Commodity ETFs, as they are not exposed to external stimuli from quarterly earnings, press releases, and governance like traditional securities issued by companies are. It can be hypothesized that their dynamics -- in short windows -- are largely governed by the supply-and-demand forces of its underlying market participants.

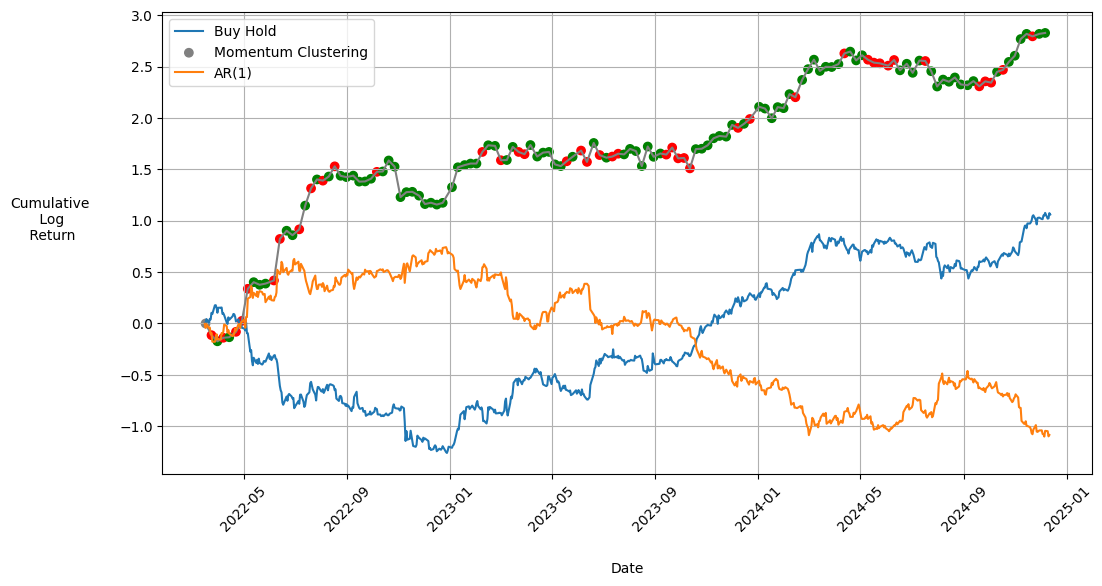

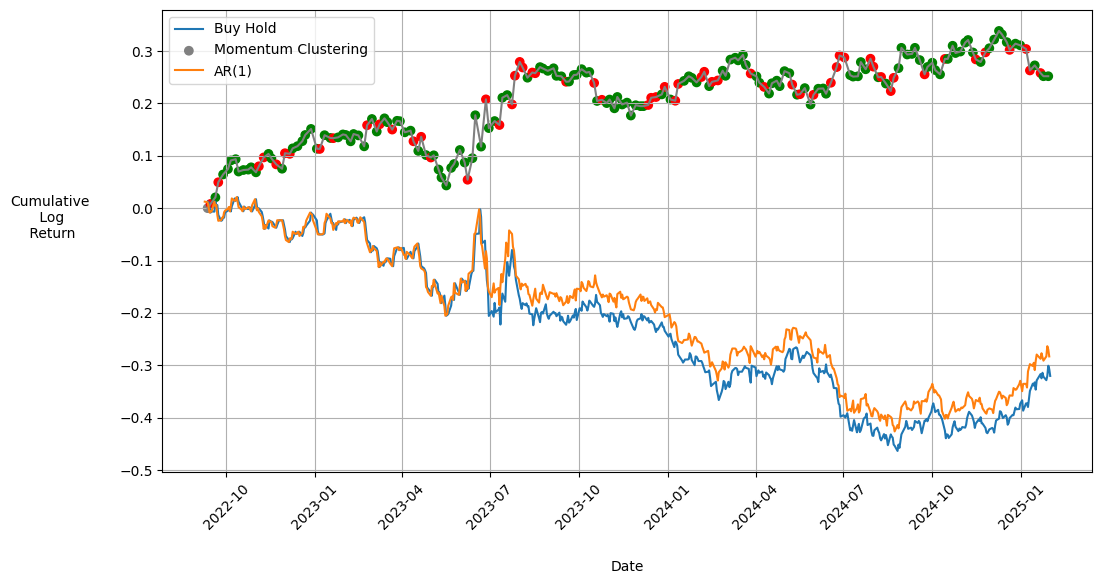

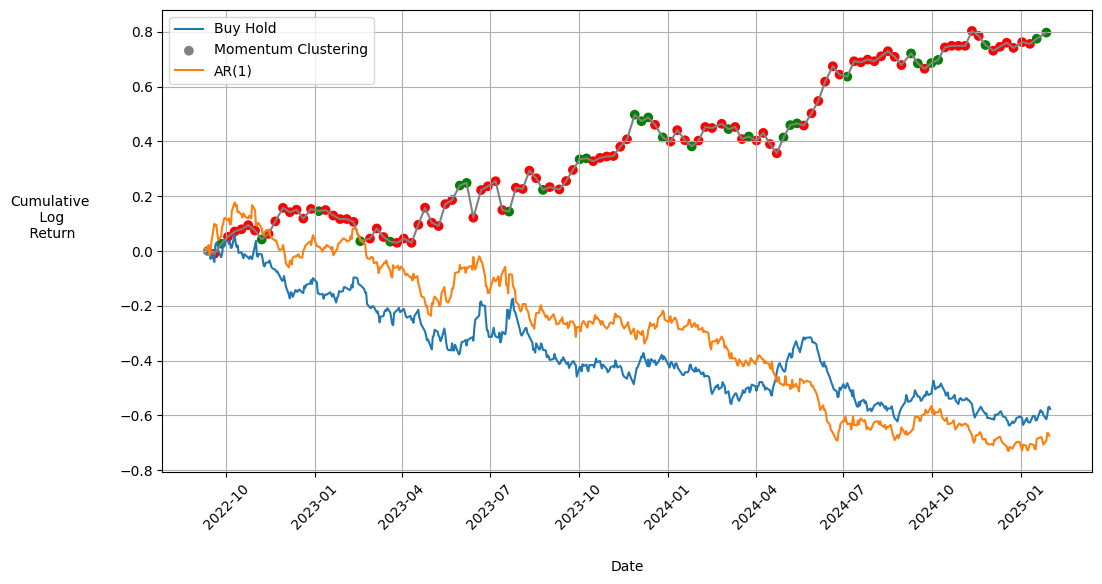

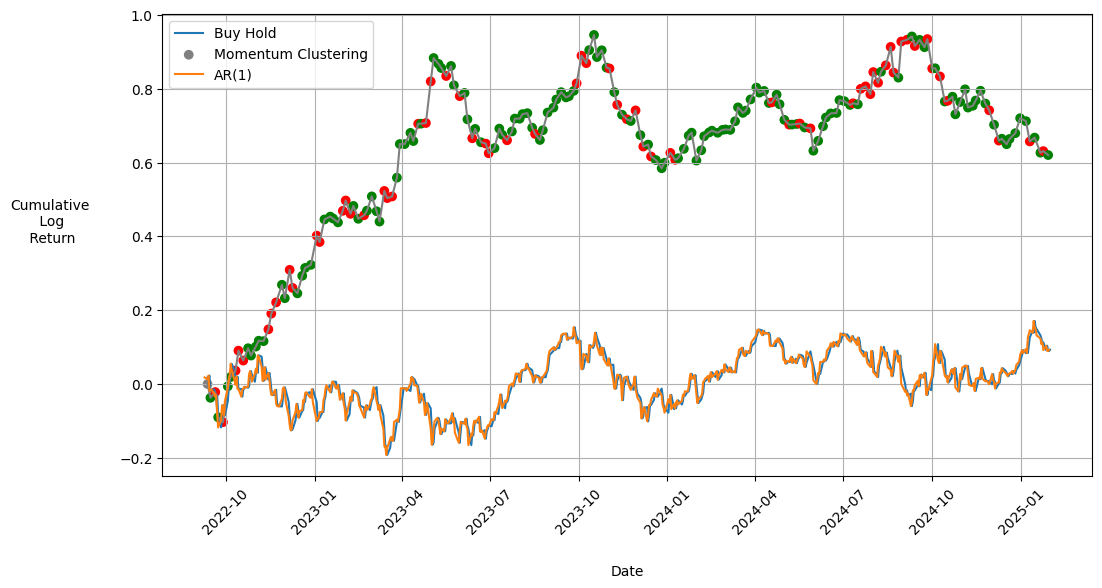

Thus, one can treat the partitioned segments as vectors and cluster them into groups that point in similar directions. Then, a probabilistic model can tell you what type of cluster may come next given the current observation. In the financial context, one can be long when positive return clusters are expected in the future and short otherwise. This is demonstrated below.

Paper PDF

Results

Green - Long Position Taken

Red - Short Position Taken

Y-Axis - Cumulative Log Return